Latest News and Articles

See below the list of our latest news and articles from our BLOG on the Einsure website:

How Different Factors Can Affect Car Insurance Premiums

When searching for car insurance, you may wonder why one person pays significantly more – or less – than another, even if their cars seem similar. The truth is, car insurance premiums are calculated based on a wide range of factors, many of which are specific to the individual driver.

At Einsure, we’re committed to helping you understand how your quotes are calculated, so you can make informed decisions and potentially reduce your costs. Below are some of the key factors that influence how much you pay for your car insurance.

1. Your Age and Driving Experience

Age can play a major role in determining insurance premiums. Statistically, younger and less experienced drivers are more likely to be involved in accidents, which means they typically face higher premiums. Drivers under 25 often pay the most, while older, more experienced drivers with a clean record tend to pay less.

Even if you’re older but newly licensed, insurers may still classify you as high risk until you build up a driving history.

2. Your Driving History and Claims Record

Insurers assess your risk by reviewing your past. If you have a history of claims, accidents or motoring convictions, your premium will likely be higher. Conversely, if you have a clean driving record and a history of no claims, you may qualify for a No Claims Discount (NCD), which can significantly reduce your insurance costs over time.

It’s essential to be honest when declaring previous incidents – failing to do so can invalidate your policy.

3. Where You Live and Park Your Vehicle

Your postcode can affect your premium more than you might expect. Insurers consider factors such as local crime rates, traffic congestion, and accident statistics when calculating risk. For example, living in a busy city or an area with high rates of vehicle theft might increase your premium compared to living in a quieter rural location.

Where you park your car overnight – whether on the street, in a driveway or in a locked garage – also influences your rate. Secure parking generally reduces your risk and can result in lower premiums.

4. The Type of Car You Drive

The make, model and value of your car all impact your insurance cost. Cars are categorised into insurance groups (1–50), with group 1 being the cheapest to insure and group 50 the most expensive. High-performance vehicles, luxury cars or models with costly parts are typically more expensive to cover.

Modifications, even cosmetic ones, can also increase your premium, as they may affect the car’s value, performance or theft risk.

5. Your Annual Mileage

The more you drive, the higher the chance you’ll be involved in an accident. That’s why your estimated annual mileageaffects your insurance premium. If you use your vehicle daily for long commutes, you’re likely to pay more than someone who only drives occasionally.

That said, underestimating your mileage to try and reduce your quote could invalidate your insurance, so it’s important to be accurate.

6. Your Job Title and Employment Status

Insurers use your occupation to help assess risk. Certain professions are statistically associated with higher risk – for example, delivery drivers or entertainers may pay more than office workers.

Your job title can make a difference, even when duties are similar. Tools such as MoneySavingExpert’s job picker can help you find the most cost-effective but honest way to describe your role.

7. The Level of Cover You Choose

There are three main types of car insurance cover:

-

Third-party only – covers damage to other vehicles, but not your own.

-

Third-party, fire and theft – adds protection if your car is stolen or damaged by fire.

-

Comprehensive – covers you and your vehicle, even if you’re at fault.

While third-party cover is the legal minimum, comprehensive insurance is not always the most expensive, and it can offer better value depending on your circumstances.

8. Your Voluntary Excess

Excess is the amount you agree to pay towards a claim. The higher the voluntary excess you choose, the lower your premium may be. However, you must make sure it’s an amount you could afford to pay out of pocket if you need to make a claim.

How Einsure Can Help

With so many factors affecting your premium, the best way to find a good deal is to compare quotes across multiple providers. Einsure’s comparison tool allows you to:

-

Enter your details once

-

View quotes from a range of trusted UK insurers

-

Tailor your cover based on your personal needs

-

See how small changes affect your premium in real time

Whether you’re a new driver, renewing your policy or looking to switch providers, Einsure helps you make confident, informed decisions.

Final Thought

Car insurance premiums aren’t one-size-fits-all. By understanding the factors that influence your quote and using a reliable comparison tool like Einsure, you can take control of your policy and potentially save money.

Start comparing today and see how much you could save.

Airalo vs Holafly: The Best eSIM Option for Smart, Connected Travel

Staying connected while travelling is no longer just a convenience — it’s essential. Whether you’re accessing travel insurance documents, calling for roadside assistance, or simply navigating unfamiliar streets, mobile data is critical.

eSIM technology has made it easier than ever to get online without swapping out physical SIM cards. Two of the most trusted names in the eSIM market today are Airalo and Holafly. But which is better for your next trip?

At Einsure, we’ve done the homework for you. Here’s what sets each service apart, who they’re best suited for, and a few expert tips to maximise value.

🔍 Quick Comparison: Holafly vs Airalo

| Feature | Airalo | Holafly |

|---|---|---|

| Data Type | Fixed GB (1GB–20GB) | Unlimited data in most regions |

| Price Range | 💸 Lower | 💰 Moderate |

| eSIM Activation | ⏳ Can be delayed | ⚡ Instant via app, email & WhatsApp |

| App Experience | 📱 Improving | 📱 Smooth and intuitive |

| Support | In-app, email | 24/7 via WhatsApp, app, and email |

| Best For | Budget-conscious, light users | Heavy users, long stays, business |

💡 Why Choose Airalo?

Airalo is ideal for travellers who are mindful of their data usage and looking for an affordable, no-frills solution. With options starting at just a few dollars, you can pick from regional or country-specific plans.

✅ Pros:

Extremely cost-effective

Wide availability across 190+ countries

Perfect for short trips or casual usage

Simple dashboard to track usage

❌ Cons:

Delivery of eSIM details can take time

Previously had a clunky setup, though it’s now improved

No unlimited data, so usage must be monitored

Einsure Insight: If you’re using eSIM just for maps, emails, and insurance access — Airalo gives you what you need without overspending.

🔥 Why Choose Holafly?

Holafly offers a more premium, worry-free experience. With unlimited data in most countries (including the UK, Europe, and the U.S.), it’s perfect for travellers who stream, work remotely, or don’t want to deal with data caps.

✅ Pros:

Truly unlimited data — no daily limits

Lightning-fast setup via app, email, and even WhatsApp

Seamless activation — just tap and install

Outstanding customer support, 24/7

Join the Travel Club to earn Holapoints (loyalty rewards)

❌ Cons:

Slightly higher pricing than Airalo

Tethering/hotspot not allowed on unlimited plans

Einsure Insight: For longer trips, family travel, or business abroad, Holafly removes the stress of running out of data.

✈️ Pro Tips for Getting More from Holafly

Install the Holafly app: You’ll get an automatic 5% discount.

Join the Travel Club: Earn Holapoints with every purchase to use as discounts later.

Buy one eSIM, then wait: You’ll often receive an email discount code (5–10%) for future orders. Great for multi-country trips.

⚠️ Important Notes for Airalo Users

eSIM activation can take up to 30 minutes — don’t leave it until the airport lounge.

The installation process is easier now, but you should still install while connected to reliable Wi-Fi.

Take a screenshot of your eSIM details in case you lose app access.

✅ Final Verdict: Which One is Right for You?

If you’re:

A budget traveller

On a short city break

Planning to use only light data

👉 Go with Airalo — it’s affordable and simple.

If you:

Need unlimited data

Stream or work remotely

Travel for longer periods

👉 Go with Holafly — the convenience and unlimited data is worth the few extra pounds.

🙋♀️ FAQs – eSIM Essentials

What’s better for unlimited data: Airalo or Holafly?

Holafly. Airalo does not offer unlimited data plans.

Can I install an eSIM before travelling?

Yes — and you should. Holafly even lets you install directly via their app or email, so you’re connected the moment you land.

Can I use my regular SIM card at the same time?

Yes, modern phones support dual SIM. Use your eSIM for data and your physical SIM for calls/texts.

How do I save money on Holafly?

Install the app for 5% off, join the Travel Club for Holapoints, and wait for post-purchase emails that often include 5–10% discount codes.

What should I watch out for with Airalo?

Airalo is reliable, but eSIM delivery can be slow. Set it up early and ensure you’re on Wi-Fi during installation.

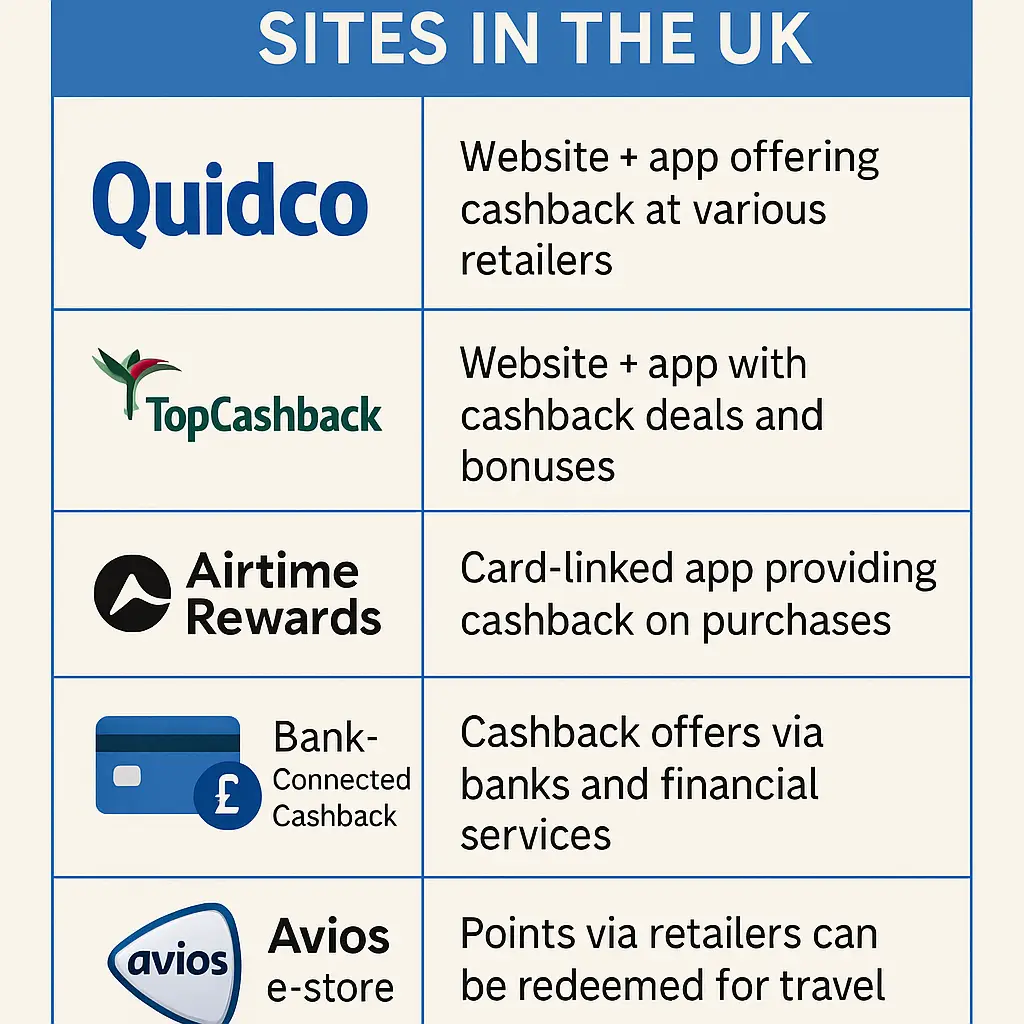

The Best Cashback Sites & Services in the UK

In an age of rising costs and smart spending, cashback websites have become a go-to tool for savvy shoppers across the UK. Whether you’re booking travel, buying groceries, or shopping online, there are plenty of ways to earn a little something back each time you spend. In this guide, we’ll explore the top cashback platforms, including website-based services like Quidco and TopCashback, app-based options such as Airtime Rewards, and even bank-integrated and points-based alternatives like Revolut and Avios.

What Is a Cashback Site?

A cashback site allows you to earn money back on purchases you make online (and sometimes in-store). Instead of going directly to a retailer, you shop via a cashback platform. The site earns a commission from the retailer for referring you—and then passes a portion of that back to you.

Top UK Cashback Services

Here are three of the best Cashback websites in the UK:

Quidco

One of the UK’s most popular and long-standing cashback sites, Quidco offers thousands of deals across fashion, utilities, insurance, travel, and more.

How it works: Register for free, shop via their website or app, and cashback is tracked and credited once the purchase is confirmed.

In-store cashback: Link your card and earn when spending at participating retailers.

Premium membership: Optional upgrade offers higher cashback rates and exclusive deals.

TopCashback

TopCashback is a close rival to Quidco and often offers slightly higher rates for certain retailers.

Features: Works almost identically to Quidco—via website, app, or browser extension.

Snap & Save: Upload receipts from physical stores to earn cashback even when shopping offline.

Memberships: Choose between a free Classic account or a paid Plus version (which adds cashback bonuses and higher payouts).

AirTime Rewards

This app takes a fresh approach to cashback. By linking your debit or credit card, you automatically earn cashback when shopping with partnered brands—and it’s paid directly toward your mobile bill.

Effortless earning: No need to click through; just spend as normal.

Mobile benefit: Cashback goes toward reducing your phone bill with most major UK networks.

Brands featured: Boots, Greggs, Wilko, Papa John’s, and more.

Cashback from Banks & Cards

Revolut

Revolut, a digital banking app, offers cashback for premium users when they spend using their card—particularly while travelling abroad. Some spending categories and retailers even offer higher rates.

Traditional Banks

A number of high-street banks also offer cashback through your current account:

Santander Edge: 1% cashback on groceries, fuel, and bills.

Barclays Blue Rewards: Cashback on selected household services.

Chase UK: Cashback of 1% on all spending for the first 12 months.

These are ideal for anyone looking to earn automatically without needing to shop via a separate website or app.

Looking to Travel? Try Avios for Points Instead of Cash

The Avios eStore allows you to collect Avios points when you shop with hundreds of well-known retailers. While you don’t earn money back, you build up points that can be used for flights, upgrades, hotel stays, and car hire with partners like British Airways and Iberia.

How it works: Similar to cashback sites—click through the Avios site to your chosen retailer, make a purchase, and points will be added to your Avios account.

Ideal for: Frequent travellers or those looking to offset travel costs.

Tips to Maximise Cashback Earnings

Compare rates: Check both Quidco and TopCashback—rates often differ between them.

Use browser extensions: These will remind you when cashback is available as you browse.

Stack rewards: Pay with a cashback debit/credit card or use linked bank offers alongside cashback sites.

Don’t forget receipts: Use features like Snap & Save to earn cashback on in-store purchases.

Track claims: Occasionally, cashback doesn’t track correctly. Take screenshots and raise a claim if needed.

Quick Cashback Comparison Table

| Cashback Method | Format | Best For | Bonus Feature |

|---|---|---|---|

| Quidco | Website/App | Variety of online retailers | In-store cashback & Premium deals |

| TopCashback | Website/App | High cashback rates | Snap & Save + Plus membership |

| Airtime Rewards | Card-linked App | Everyday spending | Pays off mobile phone bills |

| Revolut | Bank Card/App | Travel and global spending | Cashback with premium tiers |

| Avios eStore | Points System | Flights and holidays | Airmiles through everyday shops |

Final Thoughts

Using cashback services is a smart way to reduce your spending and make your money go further. Whether you prefer websites like Quidco and TopCashback, the effortless style of Airtime Rewards, or points-based programs like Avios, there’s a cashback model to suit nearly everyone.

Here at einsure, we always recommend taking full advantage of these tools—especially when combined with a cashback-friendly credit card or rewards account. You’re spending the money anyway, so why not earn some of it back?

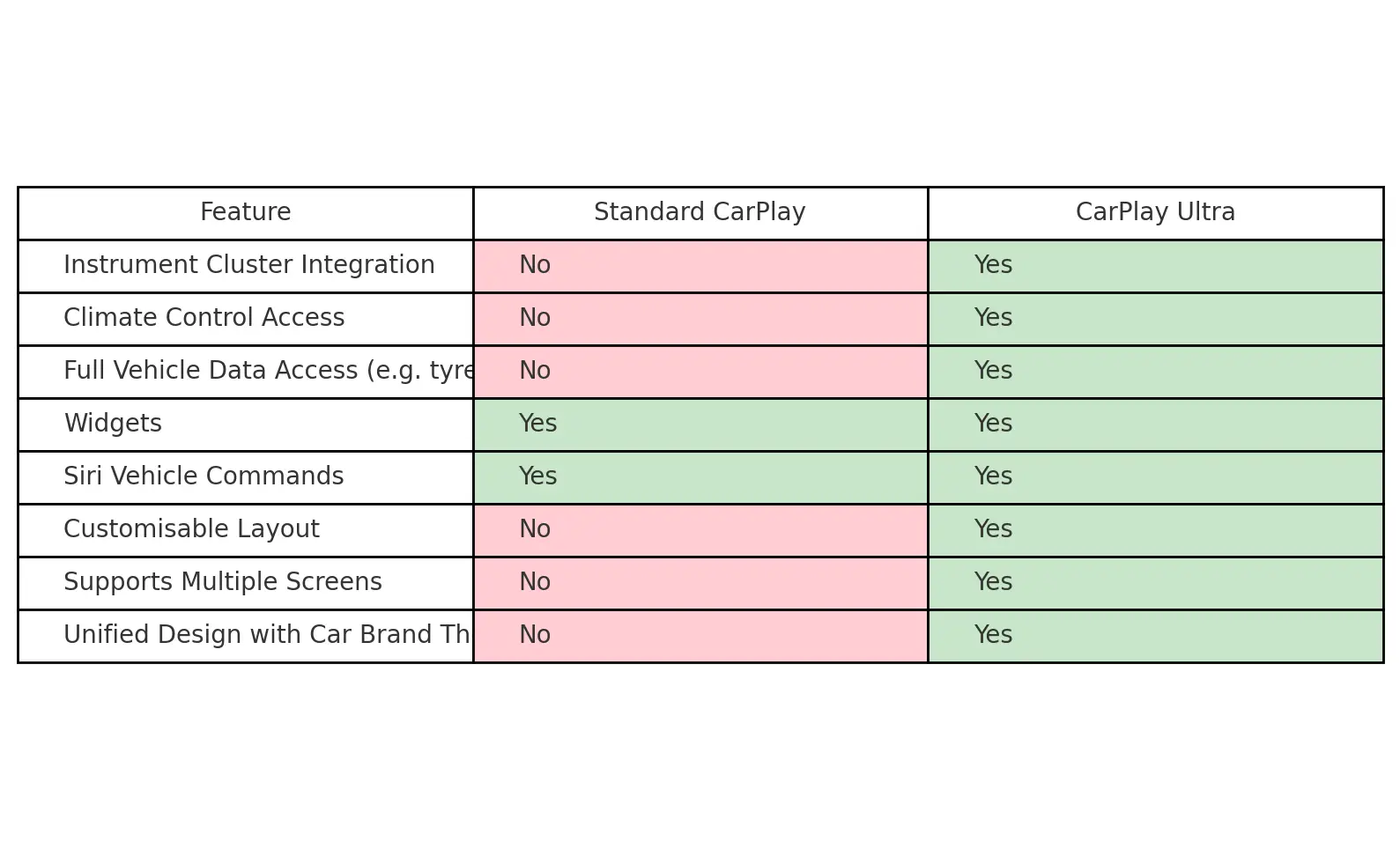

Apple CarPlay Ultra: A Glimpse Into the Future of In-Car Technology

Apple has officially unveiled CarPlay Ultra, a revolutionary update to its in-car system that could soon redefine how UK drivers interact with their vehicles. Designed to integrate more deeply into your car’s internal systems, CarPlay Ultra transforms the driving experience by extending Apple’s user interface to every screen in the cockpit.

While the rollout begins in North America—starting with Aston Martin—this innovation is set to influence vehicle design, driver safety, and insurance considerations across the UK in the near future.

📲 Official launch coverage via MacRumors

🚘 New to Apple CarPlay? Here’s a setup guide from Cocoon Vehicles

What Is CarPlay Ultra?

CarPlay Ultra is Apple’s next-generation automotive interface, expanding far beyond the infotainment screen. Unlike the traditional CarPlay experience, which mirrors selected iPhone apps onto a centre display, Ultra now controls:

The instrument cluster (speedometer, fuel, temperature)

The infotainment screen

Climate controls

Other core vehicle functions

With its intuitive design and seamless experience, CarPlay Ultra essentially turns the car’s entire digital dashboard into an Apple environment.

Key Features: What Sets It Apart?

1. Full Dashboard Integration

2. Embedded Vehicle Controls

3. Enhanced Siri Assistance

4. Widget-Based Layout

5. Seamless Ecosystem

Availability: Coming to the UK Soon

While CarPlay Ultra is now live in the United States and Canada, the first wave includes new Aston Martin models such as the:

DB12

Vantage

Vanquish

DBX

Given Aston Martin’s British roots and Apple’s partnerships with other major OEMs, it’s highly likely that UK availability will follow later in 2025.

Other brands reportedly working on CarPlay Ultra integration include:

BMW

Jaguar Land Rover

Hyundai / Genesis

Volvo

Audi

Polestar

This upgrade will be offered in models with full digital dashboards and the required hardware to support Apple’s interface.

iPhone Compatibility with Apple CarPlay Ultra

To use CarPlay Ultra, drivers will need:

An iPhone 12 or later

iOS 18.4 or newer

A compatible vehicle with CarPlay Ultra integration

Unlike earlier CarPlay versions, this iteration depends on more advanced hardware due to its deeper system control and graphical requirements.

Insurance Implications: What Should UK Drivers Know?

From an insurance perspective, CarPlay Ultra offers several potential advantages—and a few emerging concerns:

✅ Enhanced Safety

By centralising controls and improving Siri’s hands-free functionality, CarPlay Ultra reduces driver distraction—an ongoing concern in telematics and insurance underwriting.

❗ Increased Repair Costs

More sophisticated display systems and Apple-specific components may mean higher repair bills in the event of an accident—something insurers are likely to factor into premiums for newer vehicles.

✅ Driver Behaviour Monitoring

With improved integration, future iterations of CarPlay could be used to feed useful driving data to insurance providers—especially in usage-based insurance (UBI) or fleet telematics.

Final Thoughts

Apple CarPlay Ultra marks a dramatic shift in the way we engage with our cars. While it brings cutting-edge design and convenience, it also introduces new considerations around repair costs, compatibility, and how technology influences road safety.

For UK motorists, especially those purchasing or leasing premium vehicles, CarPlay Ultra is more than a feature—it’s a forward-looking investment in usability and potentially safer driving.

As availability expands across British and European models later this year, einsure.uk will continue to monitor its impact on the insurance landscape.

The Digital Driving Licence is Coming – Here’s What You Need to Know

The UK government is rolling out a new digital driving licence as part of a major push towards modernising public services. Soon, you’ll be able to carry your driving licence on your smartphone via the official Gov.uk App and Wallet—making it easier to prove your identity and manage your driving details all in one place.

For motorists and policyholders alike, this is more than just a technological shift. It’s a step towards safer, more efficient document management, which has direct implications for everything from car insurance quotes to legal compliance.

What Is the Digital Driving Licence?

The digital driving licence is an electronic version of the traditional photocard. It will be securely stored in the Gov.uk App, allowing drivers to access it on their phones at any time. Initially optional, the digital licence offers added convenience, especially for those who regularly use their licence as ID for age verification or travel.

Key Features:

Digital access to your licence, driving history and penalty points.

Integration with MOT and tax records.

Secure ID verification for use online and in shops.

Encrypted storage with two-factor authentication.

Why it matters: Keeping your driving licence information accurate helps ensure your insurance premiums are valid, your cover remains legal, and you’re not at risk of fines or invalidation.

Why You Must Keep Your Driving Licence Updated

Whether you’re still using a physical photocard or looking forward to going digital, keeping your driving licence up to date is crucial. If your address, name, or medical status changes, and you fail to inform the DVLA, you could face fines of up to £1,000. Worse, your insurance may be at risk if your licence doesn’t reflect your current details.

Impacts of Outdated Licence Information:

Insurance invalidation: Insurers rely on accurate licence data when assessing risk and setting premiums.

Legal non-compliance: Failing to update your details could lead to fines or even prosecution.

Communication delays: Renewal reminders and penalties may not reach you in time if your address is incorrect.

✅ Einsure Tip: Make it a habit to check your driving licence details every time you renew your insurance or change your vehicle.

How to Update Your Driving Licence (Step-by-Step)

Keeping your driving licence up to date is simpler than you might think. Here’s how to make changes quickly and safely.

✅ Update Online via GOV.UK:

Select the type of change you’re making (e.g. address, name, photo).

Log in using your driving licence number, National Insurance number, and passport (if renewing photo).

Follow the prompts and submit your application.

You’ll receive your new licence by post within a week.

📨 Prefer Paper? You can also:

Use a D1 application form (available at most post offices).

Complete the required sections and send it to DVLA, Swansea, SA99 1BN.

📌 Note: There is no charge for changing your address, but renewing a photo costs £14 online (or £17 by post).

CTA: Check Your Licence – Stay Covered

Your insurance cover depends on your driving record being accurate. At Einsure, we recommend reviewing your licence details at least once a year, especially if:

You’ve moved house.

You’ve changed your name.

Your eyesight or health has changed.

You’ve recently renewed your passport.

🔍 Get a quote today with Einsure – ensuring your policy reflects your current licence status can save you time, money, and hassle.

FAQs About Digital and Physical Driving Licences

Do I still need to carry my physical licence?

Yes—for now, physical licences remain valid and required in many situations. The digital version is a convenient addition, not a replacement.

Will my insurance be valid with a digital licence?

Absolutely. As long as your details are correct, it doesn’t matter if your licence is physical or digital.

Is the digital licence secure?

Yes, the Gov.uk App uses encryption and multi-factor authentication to protect your data.

Can I update my licence in the app?

Eventually, yes. The government plans to integrate this feature. Until then, changes must be made via the official GOV.UK website or by post.

What if I lose my phone?

Your digital licence will be protected by security features and can only be accessed through verified login methods. You can also report it lost or compromised via GOV.UK.

Take Control of Your Driving Records with Einsure

With the introduction of the digital driving licence, there’s never been a better time to make sure your driving and insurance records are aligned. At Einsure, we help motorists stay informed and protected—whatever road they’re on.

🎯 Need a policy that fits your driving profile?

Start your quote today with Einsure and drive with peace of mind.