Latest News and Articles

See below the list of our latest news and articles from our BLOG on the Einsure website:

Apple CarPlay Ultra: A Glimpse Into the Future of In-Car Technology

Apple has officially unveiled CarPlay Ultra, a revolutionary update to its in-car system that could soon redefine how UK drivers interact with their vehicles. Designed to integrate more deeply into your car’s internal systems, CarPlay Ultra transforms the driving experience by extending Apple’s user interface to every screen in the cockpit.

While the rollout begins in North America—starting with Aston Martin—this innovation is set to influence vehicle design, driver safety, and insurance considerations across the UK in the near future.

📲 Official launch coverage via MacRumors

🚘 New to Apple CarPlay? Here’s a setup guide from Cocoon Vehicles

What Is CarPlay Ultra?

CarPlay Ultra is Apple’s next-generation automotive interface, expanding far beyond the infotainment screen. Unlike the traditional CarPlay experience, which mirrors selected iPhone apps onto a centre display, Ultra now controls:

The instrument cluster (speedometer, fuel, temperature)

The infotainment screen

Climate controls

Other core vehicle functions

With its intuitive design and seamless experience, CarPlay Ultra essentially turns the car’s entire digital dashboard into an Apple environment.

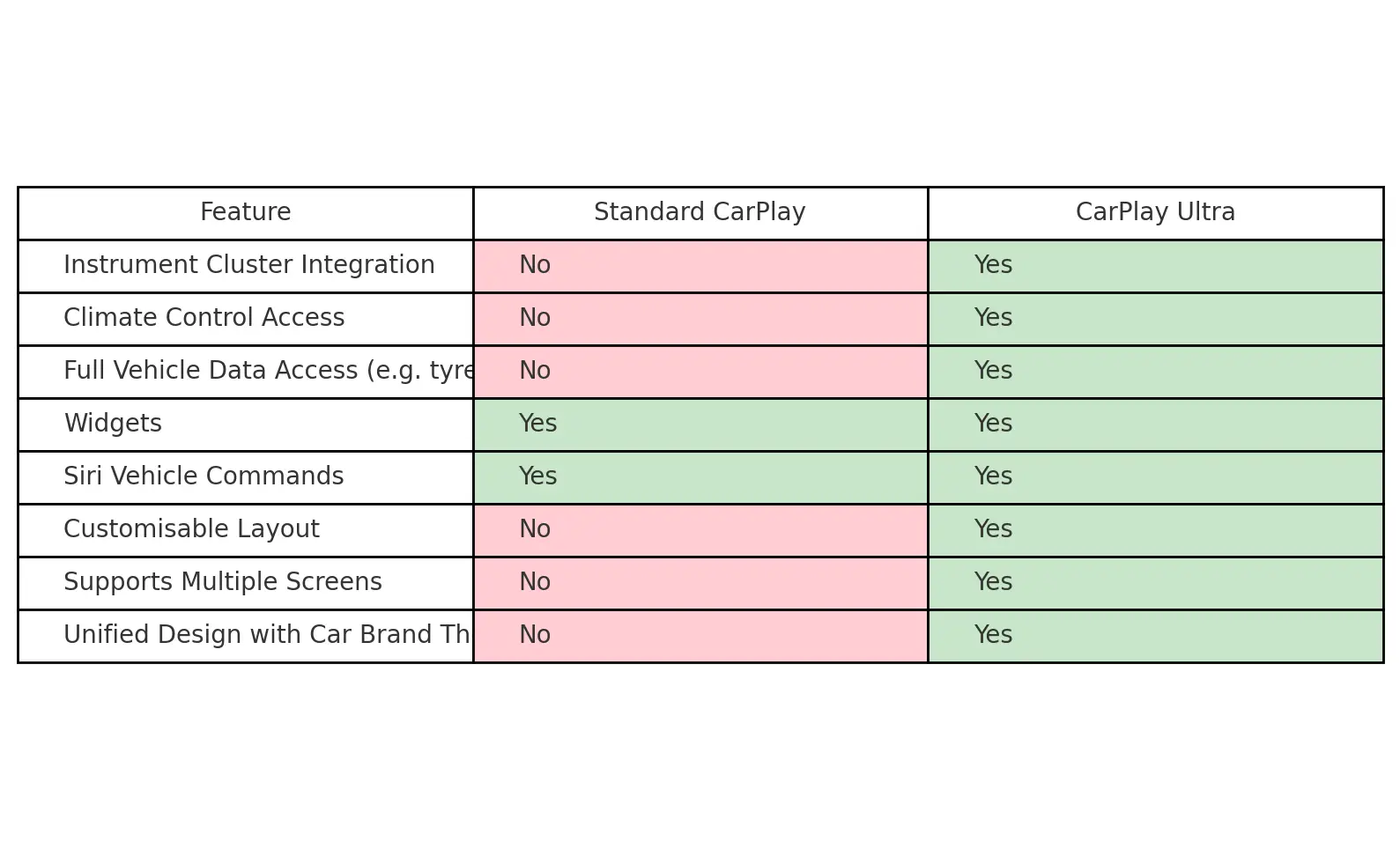

Key Features: What Sets It Apart?

1. Full Dashboard Integration

2. Embedded Vehicle Controls

3. Enhanced Siri Assistance

4. Widget-Based Layout

5. Seamless Ecosystem

Availability: Coming to the UK Soon

While CarPlay Ultra is now live in the United States and Canada, the first wave includes new Aston Martin models such as the:

DB12

Vantage

Vanquish

DBX

Given Aston Martin’s British roots and Apple’s partnerships with other major OEMs, it’s highly likely that UK availability will follow later in 2025.

Other brands reportedly working on CarPlay Ultra integration include:

BMW

Jaguar Land Rover

Hyundai / Genesis

Volvo

Audi

Polestar

This upgrade will be offered in models with full digital dashboards and the required hardware to support Apple’s interface.

iPhone Compatibility with Apple CarPlay Ultra

To use CarPlay Ultra, drivers will need:

An iPhone 12 or later

iOS 18.4 or newer

A compatible vehicle with CarPlay Ultra integration

Unlike earlier CarPlay versions, this iteration depends on more advanced hardware due to its deeper system control and graphical requirements.

Insurance Implications: What Should UK Drivers Know?

From an insurance perspective, CarPlay Ultra offers several potential advantages—and a few emerging concerns:

✅ Enhanced Safety

By centralising controls and improving Siri’s hands-free functionality, CarPlay Ultra reduces driver distraction—an ongoing concern in telematics and insurance underwriting.

❗ Increased Repair Costs

More sophisticated display systems and Apple-specific components may mean higher repair bills in the event of an accident—something insurers are likely to factor into premiums for newer vehicles.

✅ Driver Behaviour Monitoring

With improved integration, future iterations of CarPlay could be used to feed useful driving data to insurance providers—especially in usage-based insurance (UBI) or fleet telematics.

Final Thoughts

Apple CarPlay Ultra marks a dramatic shift in the way we engage with our cars. While it brings cutting-edge design and convenience, it also introduces new considerations around repair costs, compatibility, and how technology influences road safety.

For UK motorists, especially those purchasing or leasing premium vehicles, CarPlay Ultra is more than a feature—it’s a forward-looking investment in usability and potentially safer driving.

As availability expands across British and European models later this year, einsure.uk will continue to monitor its impact on the insurance landscape.

The Digital Driving Licence is Coming – Here’s What You Need to Know

The UK government is rolling out a new digital driving licence as part of a major push towards modernising public services. Soon, you’ll be able to carry your driving licence on your smartphone via the official Gov.uk App and Wallet—making it easier to prove your identity and manage your driving details all in one place.

For motorists and policyholders alike, this is more than just a technological shift. It’s a step towards safer, more efficient document management, which has direct implications for everything from car insurance quotes to legal compliance.

What Is the Digital Driving Licence?

The digital driving licence is an electronic version of the traditional photocard. It will be securely stored in the Gov.uk App, allowing drivers to access it on their phones at any time. Initially optional, the digital licence offers added convenience, especially for those who regularly use their licence as ID for age verification or travel.

Key Features:

Digital access to your licence, driving history and penalty points.

Integration with MOT and tax records.

Secure ID verification for use online and in shops.

Encrypted storage with two-factor authentication.

Why it matters: Keeping your driving licence information accurate helps ensure your insurance premiums are valid, your cover remains legal, and you’re not at risk of fines or invalidation.

Why You Must Keep Your Driving Licence Updated

Whether you’re still using a physical photocard or looking forward to going digital, keeping your driving licence up to date is crucial. If your address, name, or medical status changes, and you fail to inform the DVLA, you could face fines of up to £1,000. Worse, your insurance may be at risk if your licence doesn’t reflect your current details.

Impacts of Outdated Licence Information:

Insurance invalidation: Insurers rely on accurate licence data when assessing risk and setting premiums.

Legal non-compliance: Failing to update your details could lead to fines or even prosecution.

Communication delays: Renewal reminders and penalties may not reach you in time if your address is incorrect.

✅ Einsure Tip: Make it a habit to check your driving licence details every time you renew your insurance or change your vehicle.

How to Update Your Driving Licence (Step-by-Step)

Keeping your driving licence up to date is simpler than you might think. Here’s how to make changes quickly and safely.

✅ Update Online via GOV.UK:

Select the type of change you’re making (e.g. address, name, photo).

Log in using your driving licence number, National Insurance number, and passport (if renewing photo).

Follow the prompts and submit your application.

You’ll receive your new licence by post within a week.

📨 Prefer Paper? You can also:

Use a D1 application form (available at most post offices).

Complete the required sections and send it to DVLA, Swansea, SA99 1BN.

📌 Note: There is no charge for changing your address, but renewing a photo costs £14 online (or £17 by post).

CTA: Check Your Licence – Stay Covered

Your insurance cover depends on your driving record being accurate. At Einsure, we recommend reviewing your licence details at least once a year, especially if:

You’ve moved house.

You’ve changed your name.

Your eyesight or health has changed.

You’ve recently renewed your passport.

🔍 Get a quote today with Einsure – ensuring your policy reflects your current licence status can save you time, money, and hassle.

FAQs About Digital and Physical Driving Licences

Do I still need to carry my physical licence?

Yes—for now, physical licences remain valid and required in many situations. The digital version is a convenient addition, not a replacement.

Will my insurance be valid with a digital licence?

Absolutely. As long as your details are correct, it doesn’t matter if your licence is physical or digital.

Is the digital licence secure?

Yes, the Gov.uk App uses encryption and multi-factor authentication to protect your data.

Can I update my licence in the app?

Eventually, yes. The government plans to integrate this feature. Until then, changes must be made via the official GOV.UK website or by post.

What if I lose my phone?

Your digital licence will be protected by security features and can only be accessed through verified login methods. You can also report it lost or compromised via GOV.UK.

Take Control of Your Driving Records with Einsure

With the introduction of the digital driving licence, there’s never been a better time to make sure your driving and insurance records are aligned. At Einsure, we help motorists stay informed and protected—whatever road they’re on.

🎯 Need a policy that fits your driving profile?

Start your quote today with Einsure and drive with peace of mind.

Best eSIM Apps for Visitors to the UK

If you’re planning a trip to the United Kingdom, staying connected is key — whether for maps, booking rides, finding the best pubs, or sharing your journey. Thankfully, eSIMs have made it easier than ever to skip the local SIM card kiosks and go digital.

We’ve reviewed some of the best travel eSIM apps you can use during your trip to the UK: Holafly, Airalo, Ubigi, and Nomad. Each has its strengths, and in this guide, we’ll walk you through which one is right for your travel style, plus tips on installing eSIMs on your phone.

🌍 What is an eSIM and Why Use One in the UK?

An eSIM is a digital version of a SIM card embedded into your phone. It allows you to connect to a mobile network without inserting a physical card — perfect for international travel. You can keep your home SIM active for calls while using your eSIM for local data.

The UK has robust 4G and growing 5G networks across major cities and even smaller towns. Using an eSIM here is a convenient and often cost-effective way to avoid roaming charges.

🏆 Top eSIM Providers for Travelling to the UK

1. Holafly – Best for Unlimited Data and Simplicity

Origin: Founded in Spain in 2018, Holafly was created to solve the hassle of staying connected abroad.

Coverage: 160+ countries including strong UK support

Standout Feature: Unlimited data in the UK and across Europe

Why It’s Great for the UK

If you’re streaming on the train, using Google Maps around London, or video calling home — Holafly’s unlimited datameans you don’t have to worry about your usage. It’s especially great for tourists who need data all day, every day.

➡️ Get Holafly with this referral link

Pros:

Unlimited data in the UK

Easy installation via QR or app

Excellent support in English via WhatsApp

Cons:

No mobile hotspot with unlimited plans

Slightly more expensive than capped plans

2. Airalo – Best Budget eSIM for Light Data Users

Origin: Based in Singapore, Airalo launched in 2019 and quickly became a top marketplace for affordable global eSIMs.

Coverage: 190+ countries

UK Plan: 1GB for 7 days to 20GB for 30 days, very affordable

Why It’s Great for the UK

Airalo is great if you’re planning a short visit to the UK and just want data for navigation, messaging, and checking reservations. Their plans are cheap and can be installed in minutes.

➡️ Try Airalo using this referral link

Pros:

Extremely affordable

Pay only for what you need

Ideal for short-term or budget travel

Cons:

No unlimited data

Lower speeds if you exceed your limit

3. Ubigi – Great for Connected Cars and Frequent UK Visitors

Origin: Ubigi is operated by French telecom giant Transatel, a subsidiary of NTT Group, and is often pre-installed in smart vehicles (e.g., BMW, Jaguar).

Coverage: Available in 190 countries including strong partnerships in the UK

Why It’s Great for the UK

Ubigi is perfect for business travellers or anyone driving a connected vehicle in the UK. Their app is straightforward, and their data plans are ideal for people who visit the UK often.

Pros:

Often integrated into car systems

Secure, reliable connections

One account for global travel

Cons:

App can feel dated

Not always the cheapest for tourists

4. Nomad – Flexible and Stylish for the Modern Traveller

Origin: Based in San Francisco, Nomad was built for digital nomads and travellers needing flexibility in how they connect.

Coverage: 110+ countries

UK Plan: Choose from 1GB to 20GB options; affordable and fast

Why It’s Great for the UK

Nomad’s strength lies in its polished app, flexible pricing, and reliable coverage in the UK. It’s perfect if you want more control over your plan and appreciate a clean, user-friendly experience.

➡️ Download Nomad

🎁 Use PROMO CODE: RHYSMXCJMK for a discount!

Pros:

Flexible plans

Simple interface

Good performance in the UK

Cons:

No unlimited data option

Smaller global coverage than Airalo or Holafly

🧠 eSIM Tips for UK Visitors

Install the eSIM while still on Wi-Fi at home. Most apps allow you to scan a QR code or install directly from the app.

📲 How to Use Dual SIM on iPhone:

Go to Settings > Mobile Data > Add eSIM

Choose your travel eSIM and set it as the data line

Keep your regular SIM active for calls/texts, but disable data roaming on it

🚫 Avoid Roaming Fees

Turn off roaming on your home SIM

Make sure your travel eSIM is set for mobile data use only

Monitor your usage through the provider’s app

🏁 Final Thoughts

| Feature | Holafly | Airalo | Ubigi | Nomad |

|---|---|---|---|---|

| Origin Country | Spain | Singapore | France | USA |

| Best For | Unlimited data | Budget users | Frequent travel | App UX & flexibility |

| UK Coverage | ✅ Excellent | ✅ Very good | ✅ Excellent | ✅ Good |

| Data Hotspot | ❌ Not on unlimited | ✅ Yes | ✅ Yes | ✅ Yes |

| Price Range | 💰 Mid-High | 💸 Low | 💵 Moderate | 💵 Moderate |

🏆 Our Pick for UK Travel: Holafly

For peace of mind and no data caps while navigating UK life — from London to Loch Ness — Holafly offers unmatched convenience with unlimited data.

Frequently Asked Questions

Which eSIM is best for visiting the UK?

Holafly is ideal for travellers to the UK thanks to its unlimited data, easy setup, and strong coverage across England, Scotland, Wales, and Northern Ireland.

Can I install a UK eSIM before I arrive?

Yes, and it’s recommended! You can install your eSIM while still at home using Wi-Fi so you're ready to connect the moment you land.

Can I use an eSIM and my regular SIM together?

Yes. On most smartphones, especially iPhones, you can run your eSIM for data and keep your home SIM active for texts or calls.

Will I get 5G in the UK with these eSIMs?

Some plans support 5G, but most currently offer 4G LTE. Check with the provider if 5G is essential for your needs.

Which eSIM provider has the cheapest UK plans?

Airalo typically offers the lowest-cost plans, starting from as little as $4.50 for 1GB over 7 days.

5 Reasons to Choose a Salary Sacrifice Car Scheme

For Employers and Employees Looking for Smarter, Greener Mobility

In today’s competitive job market, offering smart, cost-effective employee benefits can make a huge difference. One increasingly popular option is the Salary Sacrifice Car Scheme, and Cocoon Vehicles is leading the way with flexible, tax-efficient solutions that work for both businesses and staff.

Whether you’re an employer looking to enhance your benefits package at no cost, or an employee seeking a more affordable way to drive a brand-new vehicle, salary sacrifice could be the perfect solution.

Here are five compelling reasons to consider this scheme – from both perspectives.

Salary Sacrifice Schemes in the UK

1. Significant Savings for Employees – Up to 60%

One of the biggest advantages for employees is the potential for huge savings on a new car. By sacrificing a portion of their gross salary before tax and National Insurance contributions, employees can save between 30–60% on a vehicle lease compared to a personal contract.

And we’re not just talking about base costs – the scheme usually includes:

Maintenance

Servicing

Tyres

Road tax

Employees get a fully inclusive package and peace of mind with no hidden costs – all while driving a new, low-emission vehicle.

2. Zero Net Cost to Employers

For employers, the Cocoon Salary Sacrifice Scheme is a no-brainer. Why? Because it’s a net zero cost benefit.

Employers simply administer the scheme through payroll, and any savings from reduced National Insurance contributions can even offset admin costs or be reinvested elsewhere. Plus, it strengthens your employee benefits offering without needing to increase salaries or take on fleet management responsibilities.

You’re effectively offering a tax-efficient benefit that boosts morale and retention – all with minimal risk and no financial outlay.

3. Flexibility to Suit All Needs – Subscriptions or Contracts

Cocoon Vehicles is unique in that it offers flexible car subscriptions as well as traditional 2–4 year salary sacrifice contracts. This allows you to tailor the scheme to suit different employee needs.

Need something short-term or with more freedom? Choose a rolling monthly subscription.

Prefer a longer-term, fixed contract? Opt for a 2, 3 or 4-year lease with all the usual benefits.

This makes the scheme suitable for businesses of all sizes, including those with employees on fixed-term contracts, probationary periods, or hybrid work models.

4. Enhances Green Credentials and Supports Net Zero Goals

Most salary sacrifice schemes focus on ULEVs (Ultra Low Emission Vehicles) and EVs (Electric Vehicles), meaning you’re encouraging employees to choose eco-friendly, lower-emission cars.

Not only does this support the UK’s wider environmental targets, but it also contributes to your organisation’s sustainability goals. It’s a positive, progressive move that aligns with CSR (Corporate Social Responsibility) values and shows your commitment to a cleaner, greener future.

Plus, many employees are eager to switch to EVs but find the cost prohibitive. Salary sacrifice makes it more affordable to go electric.

5. Attractive Employee Benefit That Helps with Recruitment and Retention

In a competitive job market, it’s more important than ever to stand out as an employer. Offering a salary sacrifice car scheme adds real value to your benefits package and can:

Attract top talent

Improve employee satisfaction

Increase long-term retention

When employees feel supported with affordable and desirable benefits, they’re more likely to stay with your business, reducing recruitment costs and staff turnover.

It’s also a benefit that speaks to a broad audience – from recent graduates to senior execs – and can be scaled across the company.

Final Thoughts

The Cocoon Vehicles Salary Sacrifice Scheme offers a win-win for both employers and employees. With zero net cost to businesses and huge tax savings for staff, it’s a powerful benefit that enhances wellbeing, supports sustainability, and modernises your mobility strategy.

Whether you opt for a flexible car subscription or a 3- to 4-year lease, Cocoon provides a streamlined, hassle-free solution that’s easy to implement and manage.

Ready to drive smarter?

Visit salarysacrifice.cocoonvehicles.co.uk and find out how you can unlock the benefits of salary sacrifice for your business or career today.

Expat Car Leasing and Subscriptions in the UK: A Smart Guide for Overseas Visitors

If you’re moving to the UK as an expat or staying for an extended visit, arranging a vehicle is often one of the first priorities. Whether it’s for commuting, exploring the country, or simply getting around day-to-day, having access to a car can make a world of difference.

However, buying a vehicle outright isn’t always the most practical choice — especially if your stay is temporary. That’s where car leasing and subscription services come into play. For expats and overseas visitors, these options provide convenient, flexible, and hassle-free alternatives to car ownership.

In this guide, we’ll explain how leasing works for expats, highlight the benefits of car subscription services, and show you how Einsure can help you compare the best car insurance policies for your chosen vehicle.

Why Leasing or Subscribing Makes Sense for Expats

Traditional car leasing in the UK often requires a solid UK credit history, a permanent address, and long-term financial commitments. This can be difficult — or even impossible — for new arrivals or those on temporary visas.

Car subscriptions and short-term leases offer a more accessible route. Providers such as Cocoon Vehicles specialise in services tailored to the expat market, removing many of the usual barriers.

What’s the Difference Between a Lease and a Subscription?

Car Leasing generally involves taking a vehicle on a fixed contract, usually between 6 and 36 months. While some providers require a credit check, expat-focused companies like Cocoon Vehicles can offer more flexible terms and accept international documentation.

Car Subscriptions are even more flexible. Typically arranged on a rolling monthly basis, they often include:

- Maintenance & Servicing

- Breakdown Cover

- Road Tax

- Ability To Switch Vehicles

- Manufacturers Warranty

This setup is ideal for expats who are unsure of their plans or need something short-term without the paperwork and upfront costs of buying.

Need a Car for Just a Month?

If you only need a vehicle for a short period — perhaps while you’re settling in, waiting for a permanent vehicle, or visiting for business — a 1-month car lease might be the perfect solution.

Cocoon Vehicles offers true 28-day leasing options that give you the freedom of a car without a long-term commitment. It’s a great middle ground between daily car hire and traditional leasing, especially for new arrivals still getting settled.

How to Choose an Expat-Friendly Provider

When selecting a leasing or subscription provider, look for the following:

- No UK Credit History Required

- Simple Application Service

- Options for Short-Term or Rolling Monthly Contracts

- Transparent Pricing

- Support for Overseas Driving Licences

Cocoon Vehicles ticks all of these boxes and more. Their customer service is geared towards expats and international clients, making the process stress-free from start to finish.

Don’t Forget the Insurance – Einsure Makes It Easy

Once your car is sorted, you’ll need to arrange car insurance before hitting the road. Whether you’ve opted for a subscription or a short-term lease, Einsure.uk helps you compare insurance quotes from multiple trusted UK providers — all in one place.

Our easy-to-use tool allows you to:

- Input your Details and Vehicle Information

- Choose the level of cover required

- Instantly compare prices across a range of car insurers

- Filter by features, excess level and more

You can tailor your quote to suit your exact circumstances — including short-term stays and expat profiles — ensuring you get the right level of cover at the best price.

This is the heading

Always provide accurate details, such as how long you plan to stay in the UK, your driving history, and where the car will be kept. Incorrect information could invalidate your policy or delay any claims.

Final Thoughts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

As an expat in the UK, getting mobile doesn’t have to be complicated. Leasing and car subscription services offer a simple, flexible way to get behind the wheel — without the stress of ownership or credit checks.

Whether you’re staying for a few months or just a single month, companies like Cocoon Vehicles are there to make the process easy. And when it comes to insurance, Einsure.uk is the perfect partner to help you find the right policy quickly and affordably.

Sort your car. Compare your insurance. Then enjoy the journey ahead.